Overview

Many employee benefits are subject to annual dollar limits that are periodically increased for inflation. The Internal Revenue Service (IRS) recently announced cost-of-living adjustments to the annual dollar limits for various welfare and retirement plan limits for 2020. Although some of the limits will remain the same, most of the limits will increase for 2020.

- The annual limits for the following commonly offered employee benefits will increase for 2020:

- High deductible health plans (HDHPs) and health savings accounts (HSAs);

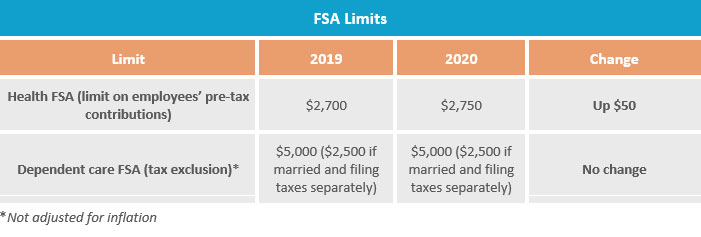

- Health flexible spending accounts (FSAs); Transportation fringe benefit plans; and

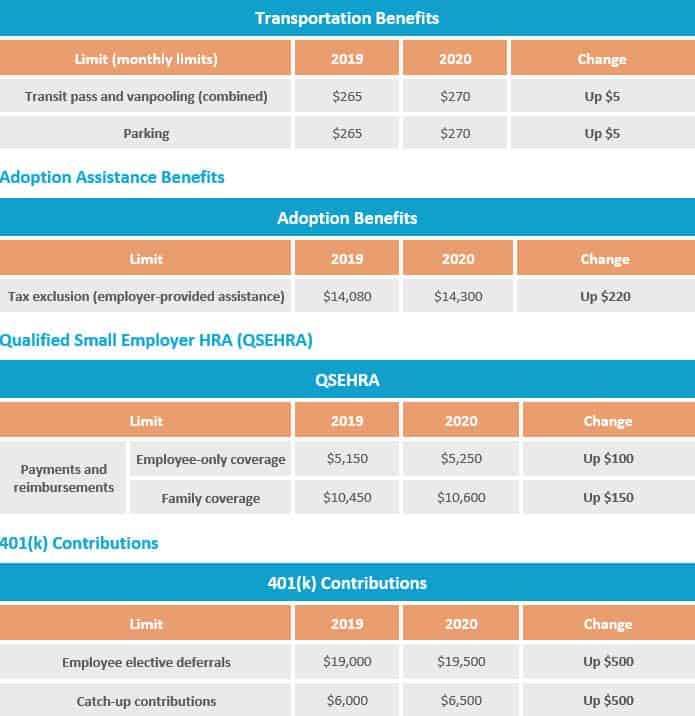

- 401(k) plans.

Action Steps

Employers should update their benefit plan designs for the new limits and make sure that their plan administration will be consistent with the new limits in 2020. Employers may also want to communicate the new benefit plan limits to employees.

HSA and HDHP Limits

FSA Benefits

Transportation Fringe Benefits

Get Assistance

Your time is valuable, let us help you. For assistance in updating your company’s benefit plan design or for other business consulting, contact Ollis/Akers/Arney.

© 2019 Zywave, Inc. All rights reserved.